Your property could be repossessed if you don't keep up your mortgage repayments.

Mortgage Payment Protection Insurance (MPPI) policies are coming to an end. Following a review of their product range, Aviva Insurance Limited are closing all policies at midnight on 31 March 2024.

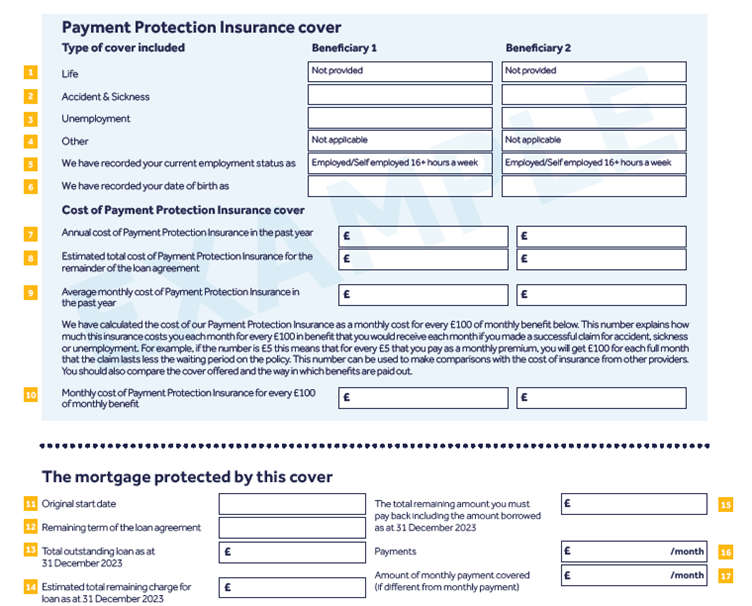

Your policy schedule provides information about how much this insurance has cost you in the past year.

Things you should know about your Optional Payment Protection Insurance:

- You can cancel your policy at any time and it won’t affect your credit. Cheaper or more appropriate cover may be available from other providers.

- There are other products that can protect you against loss of your income - for impartial information about insurance, please visit MoneyHelper.

Further details about this cover, including any significant exclusions and limitations, are included in your policy summary, which is also provided with your MPPI Annual Review. It’s important that you read your MPPI documentation to check that the MPPI policy is suitable for you.

The reference guide will help you understand the information in your MPPI annual review. You should check that all your details are correct, otherwise your insurance cover may be affected.

Key

- Life insurance is not included with this policy.

- Where Accident and Sickness cover has been selected, this is the maximum number of months the benefit is payable if you need to make a claim.

- Where Unemployment cover has been selected, this is the maximum number of months the benefit is payable if you need to make a claim.

- No other benefits are available with this policy.

- To be able to claim under this policy, you must be in paid work (employed or self-employed) for at least 16 hours per week and have been so for the last 6 months. If your employment status is incorrect, you must contact the Society immediately.

- The date of birth recorded on our files for each beneficiary.

- The cost of this policy for the period from 1 January 2023 to 31 December 2023. If you're a joint policyholder, the cost of the policy for each beneficiary will be shown based on the individual benefit levels. The figure shown takes into account all policy and premium changes from 1 January 2023 to 31 December 2023. If your policy started during this period, this figure will reflect the total payments received in this period.

- The estimated cost of this policy for either; the remaining term of the mortgage, or until you reach the age of 65, whichever is first, calculated on 31 December 2023. This is an estimate only as the calculation assumes there will be no change to the current monthly premium. Where there are joint beneficiaries, this is calculated per beneficiary and based on the individual benefit levels.

- The average monthly premium, calculated by dividing the total amount of premiums due between 1 January 2023 and 31 December 2023 by the number of months monthly premiums are due, between 1 January 2023 and 31 December 2023 (regardless of whether your mortgage has been in arrears and there are unpaid premiums between these dates). For example, if the total amount of premiums paid in 2023 was £600 and you've been paying your monthly premium each month since March 2023, your average monthly premium would be £60.

- If the monthly premium is £31.75 and the benefit you have chosen is £500 for Accident, Sickness and Unemployment, then the monthly cost per £100 of monthly benefit is £6.35. This includes Insurance Premium Tax at the appropriate rate.

- The earliest date recorded on our systems as being the start date of your mortgage.

- The remaining term of the mortgage on 31 December 2023.

- The outstanding mortgage balance on 31 December 2023, as shown on your recent mortgage statement (excluding interest and other charges.)

- The estimated total amount of interest and other charges that will be applied to your mortgage, from 31 December 2023 until the mortgage is repaid. Several assumptions have been made when calculating this amount. The calculation has used the current interest rate and any interest rate(s) which will apply thereafter, as detailed in your mortgage offer and then assumes no further changes are made to the mortgage or monthly payments before the end of the term.

- The sum of the total outstanding balance (13) and the estimated total amount of interest and other charges (14), on 31 December 2023.

- The proportion of the monthly payment made in respect of the mortgage only. This excludes any payments in respect of any insurance policies you've arranged through the Society.

- The total monthly benefit amount covered by the MPPI policy. Where there are joint beneficiaries, this is the total combined monthly benefit amount for all policyholders.

Cancellation rights

You can cancel your Payment Protection Insurance at any time. Simply call 03450 505 072 or write to Mortgage Services at Leeds Building Society, 26 Sovereign Street, Leeds, West Yorkshire, LS1 4BJ. There's no charge for cancellation.